ULIPs or Unit Linked Insurance Plans have emerged as popular investment options for investors looking for dual benefits of life insurance and wealth creation. These policies offer several advantages that allow investors with different risk profiles to participate and invest in various financial instruments in different combinations to seek good returns. Investors can expect to reap good ULIP returns in 10 years by investing in different instruments and switching allocations from time to time.

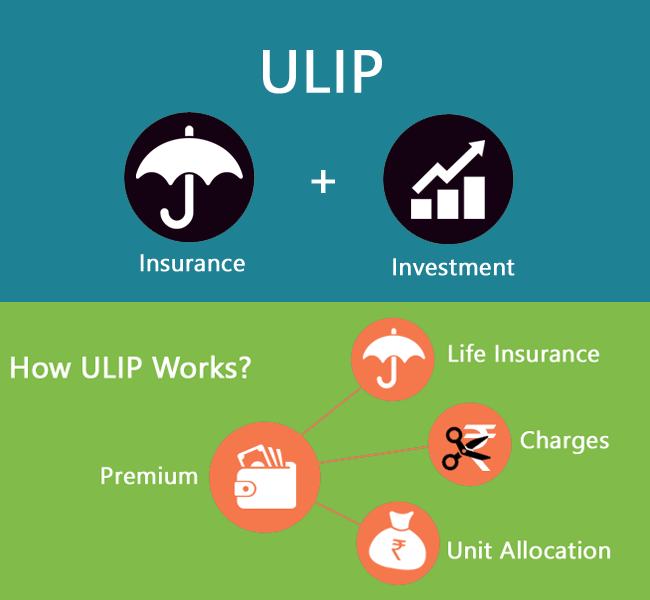

How Does a ULIP Work?

A ULIP is an insurance product that comes with a lock-in period of five years to ensure that investors stay invested for a longer duration. The returns from this scheme are market-linked. Now that we know the answer to ‘What is a ULIP policy’, we need to find out how does it work. Investors in these policies need to decide the level of life cover, the premium amount payable, the frequency of premium payments, and the term of the policy, based on their goals and saving needs.

Premiums-The premium on a ULIP policy is divided into two parts, with the first being used to provide insurance coverage, while the other being invested in equity or debt or a combination of the two. Holders of these policies have to pay certain charges related to the management of the policy, switching of asset allocation, mortality charges, and partial withdrawal or premature surrender of the policy.

Investment Allocation– The allocation of the investment aspect of the premium into various instruments is decided by the investor, based on his risk appetite. The investment funds are managed by professionals, thereby doing away with the need of a policyholder tracking his investments. Some insurance companies allow investors to choose the auto mode, wherein the investment allocation is also decided by the fund managers, keeping in mind the goals and the return expectations of the policyholder.

When policyholders choose to allocate funds at their own discretion, they can do so based on their risk appetite. A risk-averse investor may choose to invest only in a debt fund, while an investor with a high-risk appetite may invest only in equity funds. Similarly, investors looking for stable returns and willing to take some risk may opt to invest in a balanced fund investing in a mix of debt and equity instruments. The investors of ULIP also have the option to change the allocation from time to time, in response to a change in their risk appetite, the performance of a fund, changing market conditions, or any other reason.

Partial Withdrawal- The policyholders can make a partial withdrawal for funding their emergency needs. This can be done only after the completion of the lock-in period on payment of certain charges.

Top-Up Premiums– Investors have the option of using their surplus funds to buy more units on the payment of top-up premiums.

Net Asset Value- The total funds invested by the insurance company is called the corpus and divided into units with a certain face value. This is followed by the allocation of the units to the various policyholders in the proportion of their invested amount. The value of each unit is called the Net Asset Value or NAV, and its value changes with the change in the value of the underlying assets. In case a policyholder makes a partial withdrawal, the holding of units gets reduced.

Payouts under ULIPs

ULIPs offer pay-outs in case of surrender, maturity, or the untimely demise of the insured.

- Death Benefit or Sum Assured– In case of the death of the policyholder during the policy tenure, the insurance company will pay to the nominee the higher of sum assured or the fund value.

- Surrender of Policy- If a policyholder surrenders the policy during the lock-in period, the insurance company deducts the applicable charges from the fund value, but the surrender value is payable only after the completion of the lock-in period. However, if a policyholder surrenders the ULIP after the completion of the lock-in period, the insurance company pays the fund value.

- Maturity Benefit-This is the amount paid by the insurance company to the policyholder at the end of the policy period. The maturity benefit is equal to the amount of the fund value, which is calculated by the NAV of each unit multiplied by the number of units held by the policyholder.

Taxation and ULIP

Investors in ULIP are eligible for tax exemptions on premium payments as well as maturity amounts (for policies taken before February 2021).

Investors have the choice of buying a ULIP online by visiting the insurance company’s website or offline through an agent or broker.